deferred sales trust fees

The Plan is established under the Internal Revenue Code Section 457 which allows eligible employees to save and invest before-tax or Roth 457 contributions through salary deferrals. If the legal and setup fees of the deferred sales trust were each 15000 the sellertaxpayer would be in the black by the end of the first year.

Join Shauna A Wekherlien The Tax Goddess To Learn How You Can Sell Something Big Real Estate Crypto Your Car Collection Trust Words Life Things To Sell

The remaining funds will be reinvested to provide a consistent stream of.

. Learn about trust fund management fees such as the annual management fee annual expense ratio brokerage commissions and trading expenses. Ad Access Portfolio Management Consulting Opportunities at Bank of America Private Bank. The deferred sales trust DST is a legal time-tested investment strategy to defer capital gains tax on the sale of your business or property.

We partner with executives. 866-405-1031 DEFERRED SALES TRUST. The DST investing method can help you save 20-35 of your sales profit.

The Deferred Sales Trust is a unique strategy for entrepreneurs and investors looking to maximize the sale value of their business assets and real estate. The Bottom Line Delaware Statutory. Capital gains refer to the profit you made off your.

I want you to. The deferred sales trust DST is a proven strategy for capital gains tax avoidance upfront. Fee is based on a sliding scale.

Our reach is national. Call for free case evaluation. Please follow the instructions to add an event to my calendar.

Welcome to my scheduling page. Darrow Wealth Management is an asset management and financial planning firm with offices in Boston MA and Needham MA. Fees to set up a DST are institutionally priced including the initial legal fees to set up the trust and the independent trustees fees all of which are disclosed in the engagement letter.

Trust Planning ensures you do not lose what youve earned. 2022 rate chart is available upon request. Is The Deferred Sales Trust Too Expensive With David Young Brett Swarts Brett.

Whereby the upfront fee set up the. I want you to better understand how you can benefit from a deferred sales trust so you can make more money when you sell and have more freedom with your time. They would continue to earn.

A family of over fifty funds covering all areas of the investment spectrum. 2022 rate chart is available upon request. Fee is based on a sliding scale.

Ad Protect Your Property. You may also be. Rather than a typical transaction where the seller would receive funds.

A Zoom invite will be emailed with a conference call. Deferred sales trust fee. Ad Wells Fargo Can Help Work with You Your Team of Advisors to Get What You Need.

The DSTs is too expensive but the ongoing fees David. If youd like to sell a rental property business or other highly appreciated asset but are dreading the capital gains a Deferred Sales Trust may be for you. A married couple ready for retirement plans to sell their 1 million asset and will owe 250000 in capital gains tax.

A deferred sales trust DST allows for the deferral of capital gains tax when selling real estate or other qualified assets. A Checklist for Trust Funds Organizing Your Financial Documents. Fees can include selling commissions broker-dealer allowance offering and organizing expenses asset acquisition and disposition costs among others.

Ad Access Portfolio Management Consulting Opportunities at Bank of America Private Bank. Call for free estate planning evaluation.

Section 202 Portal Portal Oregon Swimming Life

Kirsten On Instagram Some Revision Notes I Ve Written So Many Pages Over The Last Two Days I Ve Had T Revision Notes School Organization Notes Study Notes

Pin By Cpec 1031 Exchange On Aircraft 1031 Exchanges Www Cpec1031 Com Deferred Tax Investing Trust Yourself

Applicable Nav Net Asset Value Nav Financial Peace Dividend Reinvestment Plan How To Apply

Sample Printable Offer To Second Lien Holder Lender Form Real Estate Forms Word Template Real Estate Contract

Can A Foreign Taxpayer Utilize The Dst Capital Gains Tax Capital Gain Wealth Planning

The 721 Exchange Or Upreit A Simple Introduction Estate Planning Capital Gains Tax Real Estate Investor

My Story Capital Gains Tax Capital Gain Story

Pin On Tax Tips From Tax Goddess

Free Land Trust Addendum Form Printable Real Estate Forms Real Estate Forms Land Trust Word Template

Escrow Is An Arrangement In Which A Neutral Third Party Escrow Agent Takes Instruction From Buyer And Seller To Process Escrow Process Insurance Fund Escrow

A Real Estate Exit Strategy That Can Save On Taxes Home Staging Tips Home Staging Best Paint Colors

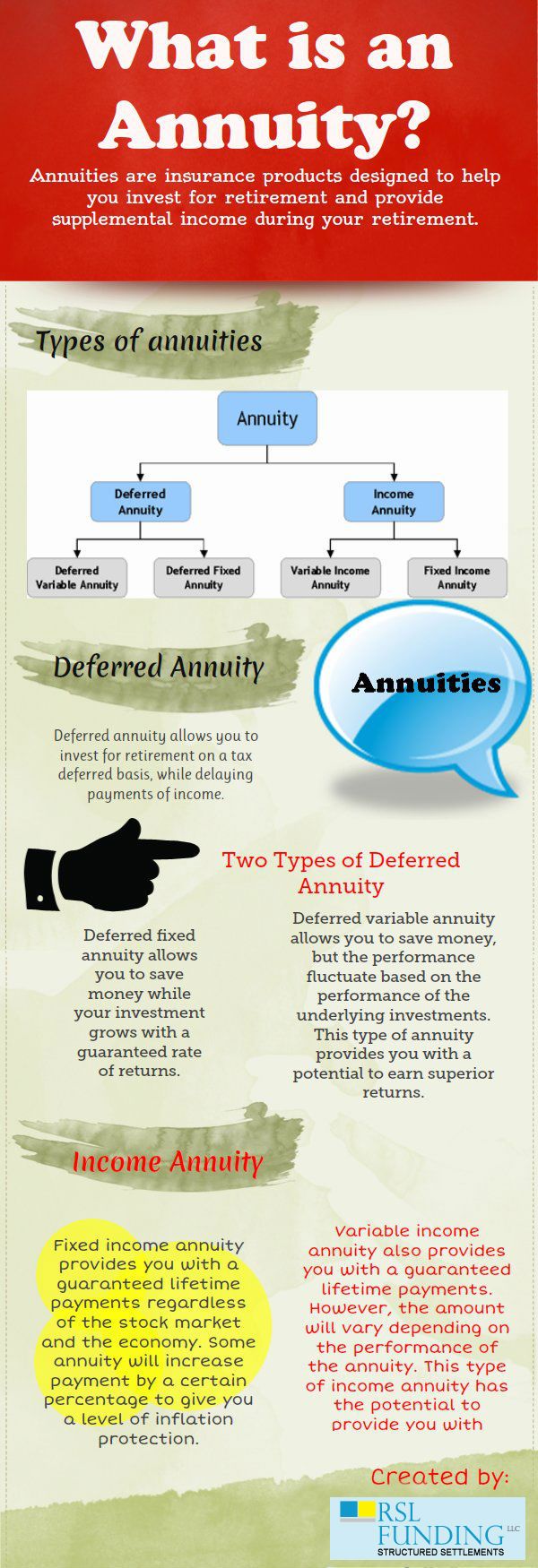

What Is An Annuity Investing For Retirement Annuity Investing Money

Stratking Accounting And Tax On Instagram Information About Stratking Accounting And Tax Professional Corporation

What Stash Does To Keep You Safe Brand Refresh Stash Brand

Free Printable Checklist For Sales With New Loans 4 Form Printable Checklist Real Estate Forms Notes Template

A Successful Man Is One Who Can Lay A Firm Foundation With The Bricks Others Have Thrown At Him David Brinkley Be Business Quotes Successful Men Lettering

Free Copy Of Projected Foreclosure To Reo Cost Analysis 2nd Lein Printable Real Estate Forms Word Template

Latest Episode Of The Clarified Realty Podcast Featuring Richard Hershey Discussing Deferred Sales Trusts Real Estate Investing Capital Gains Tax Trust Words